第一节 金属矿产品期货

金属矿产品期货交易品种涉及十数种金属矿产品。伦敦金属交易所(LME)是世界上最权威的金属期货交易所。中国期货市场上到2002年9月,保留了铜、铝两种金属矿产品期货,期货合约在上海期货交易所交易。

一、有色金属期货

(一)铜期货

铜的基础知识:铜是与人类关系非常密切的有色金属,被广泛地应用于电气、轻工、机械制造、建筑工业、国防工业等领域,在我国有色金属材料的消费中仅次于铝。铜在电气、电子工业中应用最广、用量最大,占总消费量一半以上。

全球铜蕴藏最丰富的地区共有五个:①南美洲秘鲁和智利境内的安第斯山脉西麓。②美国西部的洛杉矶和大坪谷地区。③非洲的刚果和赞比亚。④哈萨克斯坦共和国。⑤加拿大东部和中部。铜资源主要集中在智利、美国、赞比亚、独联体和秘鲁等地。智利是世界上铜资源最丰富的国家,其铜金属储量约占世界总储量的1/4。美国、日本是主要的精炼铜生产国,赞比亚和扎伊尔是非洲中部的主要产铜国,其生产的铜全部用于出口,德国和比利时是利用进口铜精矿和粗铜冶炼精铜的生产国。此外,秘鲁、加拿大、澳大利亚、巴布亚新几内亚、波兰、前南斯拉夫等也均是重要的产铜国。

铜的消费集中在发达工业国。美国是最大的铜消费国,约占世界消费总量的1/5,其次是中国、日本、德国。

智利是世界上最大的铜出口国,主要输往美国、英国、日本等地;其次是赞比亚、秘鲁、扎伊尔、澳大利亚等国。世界上主要的铜进口地有美国、日本、欧共体、中国。

铜的期货交易主要集中在伦敦金属交易所(LME)和纽约的交易所。LME铜的报价是行业内最具权威性的报价。在该交易所,铜的期货主要用美元报价交易。下面是上海期货交易所阴极铜合约标准及有关规定:

交易品种 阴极铜

交易单位 5吨/手

报价单位 元(人民币)/吨

最小变动价位 10元/吨

合约交割月份 1~12

交易时间 上午9:00~11:30,下午13:30~15:00

最后交易日 合约交割月份15日(遇法定假日顺延)

交割日期 合约交割月份的16日至20日(遇法定假日顺延)

交割等级 1.标准品:标准阴极铜,符合国标《GB/T467—1997》标准阴极铜规定,其中主成分铜加银含量不小于99.95%。

2.替代品:a.高级阴极铜,符合国标《GB/T467—1997》高极阴极铜规定,经本所指定的质检单位检查合格,由本所公告后实行升水;

b.LME注册阴极铜,符合《BS6017—1981》和《AMD5725》标准(阴极铜级别代号CU—CATH—1)。

交割地点 交易所指定交割仓库

交易保证金 合约价值的5%

交易手续费 不高于成交金额的万分之二(含风险准备金)

交割方式 实物交割

交易代码 CU

附:LME A级铜期货合约英文文本

Size of Lot

25tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movement

50cents per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 21months(A total of 27 months forward).

Quality

The copper grade A delivered under this contract must be electrolytic copper in the form of cathodes-grade A All copper grade A delivered must be of brands listed in the LME-approved list of copper grade A brands and must conform to BS EN 1978:1998(cathode grade designation Cu-CATH-1).

Shapes &Weights

Each parcel of 25tonnes shall lie at one warehouse and be of one brand,shape and size and shall be of full or cut plates subject to the necessity of including different shapes and sizes at the bottom of each parcel for the purpose of palletisation.Cut plates shall not be less than quarter size.Each parcel of copper cathodes placed on warrant shall be delivered securely strapped in bundles not exceeding 4tonnes and with the brand shown on the strapping.On and after 18th December 1995,each parcel of copper cathodes placed on warrant shall be securely strapped for handling and transport in bundles to permit safe handling without bundle distortion and breakage.Additionally,on and after 17th August 1999each parcel of copper cathodes placed on warrant shall be delivered with the brand name shown on clips attached to the producer’s bundle strapping or the brand name marked continuously on the producer’s bundle strapping.

(二)铝期货

铝的基础知识:铝是世界上最为广泛应用的金属之一。铝主要应用在建筑业、航空及国防军工、电力输送、汽车制造、集装箱运输、日常用品、家用电器、机械设备等领域。根据铝锭的主成分含量可以将铝分成三类:高级纯铝(铝的含量99.93%~99.999%)、工业高纯铝(铝的含量99.85%~99.90%)、工业纯铝(铝的含量98.0%~99.7%)。

世界上铝土矿资源总量约在400亿~500亿吨,储量较大的国家有几内亚、澳大利亚、巴西、牙买加及印度等,这些国家的铝土矿占世界铝土矿总储量的73%。而产铝量主要集中在美国、俄罗斯、中国、加拿大、澳洲、巴西、挪威等国。

世界上最大铝消费国是美国、中国、日本、德国。

铝的期货交易主要在伦敦金属交易所(LME)和纽约商品交易所(COMEX)进行,尤其是伦敦金属交易所(LME)的铝锭成交价是世界铝交易的代表性价格——该交易所主要用美元叫价交易。下面是上海期货交易所铝期货合约文本:

交易品种 铝

交易单位 5吨/手

报价单位 元(人民币)/吨

最小变动价位 10元/吨

合约交割月份 1~12

交易时间 上午9:00~11:30,下午13:30~15:00

最后交易日 合约交割月份的15日(遇法定假日顺延)

交割日期 合约交割月份的16日至20日(遇法定假日顺延)

交割等级 标准品:铝锭,符合国标GB/T1196—93标准中AL99.70规定,其中铝含量不低于99.70%替代品:LME注册铝锭,符合P1020A标准

交割地点 交易所指定交割仓库

交易保证金 合约价值的5%

交易手续费 不高于成交金额的万分之二(含风险准备金)

交割方式 实物交割

交易代码 AL

上市交易所 上海期货交易所

附:LME铝期货合约主要条款

Size of Lot

25tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movement

50cents per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 21months(A total of 27months forward).

Quality

The aluminium deliverable under this contract shall be:

a)primary high grade aluminium of minimum 99.70% purity with maximum permissible iron content 0.20% and maximum permissible silicon content 0.10%,or

b)primary high grade aluminium with impurities no greater than in the registered designation P1020Ain the Registration Record of Aluminum Association Designations and Chemical Composition Limits for unalloyed aluminium of the Aluminum Association Inc.,U.S.A.(May 15th,1982)

c)The aluminium deliverable under this contract shall be of brands listed in the LME-approved list of aluminium brands.

Shapes &Weights

Aluminium delivered may be in the form of ingots,Tbars or sows.Ingots shall be securely strapped in bundles suitable for stacking.Ingot weight shall be within the permitted range 12kg to 26kg each.T-bar weight shall not exceed 5%more than 675kg each and on or after 18th January 2000,T-bar weight shall not exceed 5% more than 750kg.The weight of each sow shall not exceed 5%more than 750kg.

二、铅、锌、镍、锡期货

中国境内期货市场到2002年9月,已无铅、锌、镍、锡期货交易。以下简要介绍伦敦金属交易所(LME)铅、锌、镍、锡期货合约的主要内容。

(一)铅期货

伦敦金属交易所(LME)铅期货合约的主要内容:

交易品种 精炼铅

交易单位 25吨/手

最小变动价位 0.50美元/吨

附:LME铅期货合约主要条款

Size of Lot

25tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movement

50cents per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 9months(A total of 15months forward).

Quality

The standard lead delivered under this contract must be refined pig standard lead(minimum 99.97%purity).All standard lead delivered must be:

a)of brands listed in the LME-approved list of standard lead brands

b)in ingots weighing not more than 55kgs each.Shapes &Weights

Each parcel of 25tonnes shall lie at one warehouse and be of one brand and shall consist of ingots of one size,subject to the necessity of including different shapes and sizes at the bottom of each parcel for the purpose of palletisation.On and after 6th May 1992each parcel placed on warrant shall be delivered securely strapped,in bundles not exceeding 1.5tonnes.Each parcel placed on warrant between 1st June 1985and 5th May 1992 shall be delivered securely strapped,in bundles not exceeding 1.2tonnes.Additionally,on and after 16th October 1995,each parcel placed on warrant shall be securely strapped in bundles to permit safe handling without bundle distortion and breakage.

(二)锌期货

伦敦金属交易所(LME)锌期货合约的主要内容:

交易品种 特级锌

交易单位 25吨/手

报价单位 美元/吨

最小变动价位 50美分/吨

附:LME锌期货合约主要条款(英文文本)

Size of Lot

25tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movement

50cents per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 21months(A total of 27 months forward).

Quality

The zinc delivered under this contract must be zinc of minimum 99.995%purity.Zinc placed on warrant on or after 1st November 2000must conform with the 99.995%graded zinc chemical composition of the BS EN 1179:1996Standard entitled“Zinc and Zinc Alloys-Primary Zinc”.All zinc delivered must be:

a)of brands in the LME-approved list of special highgrade zinc brands;

b)in ingots(slabs and plates will be referred to as ingots)weighing not more than 55kgs each.

Shapes &Weights

Each parcel of 25tonnes shall lie at one warehouse and be of one brand and shall consist of either slabs,plates or ingots of one size subject to the necessity of including different shapes and sizes at the bottom of each parcel for the purpose of palletisation.Each parcel placed on warrant shall be delivered securely strapped in bundles not exceeding 1.5tonnes.Additionally,on and after 18th December 1995,each parcel placed on warrant shall be securely strapped in bundles to permit safe handling without bundle distortion and breakage.

(三)镍期货

伦敦金属交易所(LME)镍期货合约的主要内容:

交易品种 原镍

交易单位 6吨/手

报价单位 美元/吨

最小变动价位 5美元/吨

附:LME镍期货合约主要条款(英文文本)

Size of Lot

6tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movemen

$5per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 21months(A total of 27 months forward).

Quality

The primary nickel delivered under this contract must be primary nickel of minimum 99.80%purity with chemical analysis conforming to the current ASTM specification.

Shapes &Weights

All primary nickel delivered must be:

a)of the production of those producers named in the LME-approved list

b)in the form of either cathodes or pellets or briquettes.

In the case of cathodes deliveries shall be made in the form of

a)sizes cut to either 100mm×100mm(4″×4″),50mm×50mm(2″×2″),or 25mm×25mm(1″×1″),size tolerances in accordance with internationally accepted trade practice.

b)sizes of full plate,excluding loops,up to 1000mm×1300mm maximum with a thickness range of 2mm to 15mm.

Each warrant of drummed or nickel cathodes shall consist of only one size.

All cut nickel cathodes,pellets or briquettes delivered shall be packed in sound steel drums with a net weight of minimum 150kgs and maximum 500kgs.On or after 16th April 1995,all such nickel delivered for warranting shall be packed in sound steel drums with an even net weight(+/-2%more or less)of minimum 150 kgs and maximum 500kgs.Each warrant shall consist of drums of uniform size and weight.The gross and net weights must be clearly marked/strapped on each individual drum together with the brand name.

Each warrant of full plate cathodes either comprising trimmed or untrimmed cathodes shall lie at one warehouse and be of one brand,shape and size.Each bundle of full plate cathodes placed on warrant shall be securely strapped in two dimensions with corrosion resistant material to permit safe handling and transport without bundle distortion and breakage on steel or wooden skids(pallets not permitted)with ground clearance of 75mm minimum.Bundles should not exceed 1.6tonnes in weight and with the brand name marked indelibly either a)on clips attached to the producer’s bundle strapping,or b)on producer’s strapping,or c)on each cathode within each bundle or d)on an indestructible tag attached to each bundle.

The lot number,gross and net weights should also be either marked indelibly on a)the top cathode within each bundle or b)an indestructible tag attached to each bundle.

(四)锡期货

伦敦金属交易所(LME)锡期货合约的主要内容:

交易品种 精炼锡

交易单位 5吨/手

报价单位 美元/吨

最小变动价位 1美元/吨

附:LME锡期货合约主要条款(英文文本)

Size of Lot

5tonnes

Major Currency

The LME uses US Dollars as its major currency for each contract,the currency in which dealings on the floor are transacted and which is used for the announcement of the official prices.However,Sterling,Euro and Japanese Yen also constitute good currencies for clearing purposes for all LME metals.Therefore the LME announces the exchange rates each day that the clearing house will use for evaluating the settlement prices.

Minimum Price Movement

$5per tonne

Delivery Dates

Daily for 3months forward,then every Wednesday for the next 3months and then every third Wednesday of the month for the next 9months(A total of 15months forward).

Quality

The tin delivered under this contract must be refined tin of minimum 99.85%purity and conforming to BS3252:1986.Warrants issued after 16th September 1996must conform to the chemical composition of BS EN 610:1996.

All tin delivered must,therefore,be:

a)of brands listed in the LME-approved list of tin brands.

b)either in ingots or slabs each weighing not less than 12kgs or more than about 50kgs.

Shapes &Weights

Each parcel of 5tonnes shall lie at one warehouse and be of one brand,shape and size,subject to the necessity of including different shapes and sizes at the bottom of each parcel for the purpose of palletisation.Each parcel placed on warrant shall be delivered securely strapped,in bundles not exceeding 1.2tonnes.Additionally,on and after 18th December 1995,each parcel placed on warrant shall be securely strapped in bundles to permit safe handling without bundle distortion and breakage.

三、贵重金属:黄金、白银、铂、钯

中国境内至2002年9月尚无贵重金属期货交易。以下简要介绍芝加哥期货交易所(CBOT)黄金和白银期货合约的主要内容。

(一)黄金期货

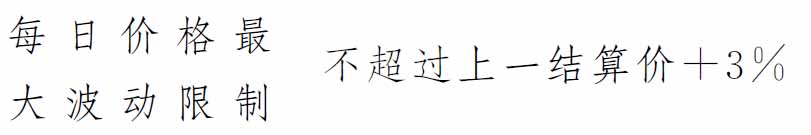

下面是芝加哥期货交易所(CBOT)100-ounce黄金期货合约的主要内容:

交易品种 100盎司金

合约单位 100精衡盎司精炼金

报价单位 美元及美分/精衡盎司

最小变动价位 10美分/精衡盎司

附:合约英文文本

100-ounce Gold futures

Trading unit 100fine troy ounces

Deliverable grades One bar of refined gold in the form of

one 100-oz bar or three 1=kilo gold bars assaying not less than 995fineness.The total pack cannot vary from a 100troy oz weight by more than 5 percent.

Tick Size 10cents/troy oz($10/contract).

Price quote dollars and cents/troy oz

Daily Price Limit $50/troy oz($5000/contract)above or below the previous day’s settlement price(expandable to$75/troy oz).

Contract months Current month and any subsequent months,including Feb,Apr,Jun,Aug,Oct,Dec

Last trading day Fourth to the last business day of the delivery Month

Delivery method By vault receipt drawn on deposits made in exchange approved vaults in Chicago or New York

Trading Hours 7:20a.m.1:40p.m.Chicago time,Mon Fri.

Evening trading hours are 5:20-8:05 p.m.(CST)or 6:20-9:05p.m.(CDST),Sun-Thu.Trading in expiring contracts closes at 1:40p.m.on the last trading day.

Ticker Symbol GH

(二)白银期货

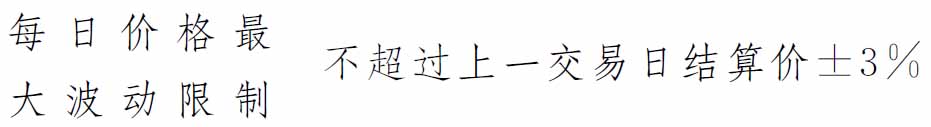

下面是芝加哥期货交易所(CBOT)1000-ounce白银期货合约的主要内容:

交易品种 1000盎司银

合约单位 1000衡盎司银

报价单位 美元及带一位小数的美分数/精衡盎斯

最小变动价位 0.1美分/精衡盎斯(1美元/每张合约)

附:合约英文文本

Silver 1000Ounce Fu

tures

Contract Size 1000troy ounces

Deliverable Grades Refined silver assaying not less than 999fineness and made up of one or more brands and markings officially listed by the exchange.Each bar must weigh 1000troy ounces.The total bar cannot vary from a 1000troy oz weight by more than 12percent.

Tick Size 10/100of a cent/troy oz($1/contract)basis Chicago

Price Quote Dollars and cents to the last 1/10of a cent/troy oz

Contract Months Current month,the next two succeeding months,plus Feb,Apr,Jun,Aug,Oct,Dec

Last Trading Day Fourth to last business day of the delivery month

Delivery Method By vault receipt drawn on deposits made in exchange-approved vaults in Chicago

Trading Hours 7:25a.m.-1:25p.m.Chicago time,Mon-Fri.Trading in expiring contracts closes at 1:25p.m.on the last trading day.

Ticker Symbols AG(Electronic Only)

Daily Price Limit $1.50/oz.($1500/contract)above or below the previous day’s settlement price.No limit in the spot month(limits are lifted two business days before the spot month begins).

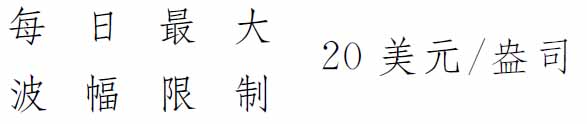

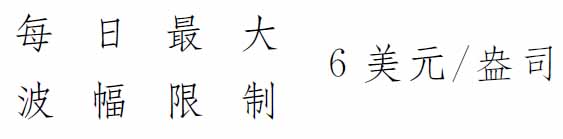

(三)铂、钯期货

铂、钯期货交易主要在纽约商品交易所进行。铂期货合约的主要内容:

交易单位 50精衡盎司

报价单位 美分/盎司

最小变动价位 10美分/盎司

交割月份1、4、7、10

钯期货合约的主要内容:

交易单位 100衡盎司

报价单位 美分/盎司

最小变动价位 5美分/盎司

交割月份 3、6、9、12

免责声明:以上内容源自网络,版权归原作者所有,如有侵犯您的原创版权请告知,我们将尽快删除相关内容。