第九章 信用证的翻译

信用证(Letter of Credit,简称L/C)是银行应进口商的请求,开给出口商,在出口商按规定的条款和条件提供各项单据时,银行以自己的信用保证履行付款的一种书面证据。作为国际贸易结算的主要支付方式,信用证在我国进出口业务中起着越来越重要的作用。

第一节 概 述

Letter of Credit(L/C)is the most generally used method of payment.A letter of credit is a letter written by the importer’s bank to the exporter,verifying the bank’s promise to pay the beneficiary(usually the exporter)upon presentation of documents relating to the dispatch of the goods,if the importer fails to effect payment.Thus it is protective of the exporter’s interests.On the other hand,it protects the importer’s interest too,because the importer receives the guarantee from the bank that the exporter will not be paid until the goods ordered have truly been dispatched and all the documents relating to the goods are in order.The documents mainly include the Contract between the exporter and importer,Bill of Lading,Insurance Policy,Inspection Certificate,etc.

The disadvantage of this method of payment is the cost,which is to be borne by the importer for opening an L/C,that is usually higher than other means of payment,and it takes a longer time.

就类型而言,信用证分为以下几种:

1.跟单信用证(Documentary Credit)

2.光票信用证(Clean Credit)

3.不可撤销信用证(Irrevocable Letter of Credit)

4.保凭信用证(Confirmed Letter of Credit)

5.议付信用证(Negotiation Credit)

6.即期付款信用证和远期付款信用证(Sight/Time Letter of Credit)

7.可转让信用证(Transferable Letter of Credit)

8.循环信用证(Revolving Credit)

9.远期信用证(Usance Credit Payable at Sight)

10.背对背信用证(Back to Back Credit)

11.对开信用证(Reciprocal Credit)

就内容而言,信用证一般包含以下几个方面:

1.The number of the credit and the place and time of its establishment.

2.The type of the credit.

3.The contract on which it is based.

4.The major parties relevant to the credit,such as the applicant,opening bank,beneficiary,advising bank.etc.

5.The amount or value of the credit.

6.The place and date on which the credit expires.

7.The description of the goods including name of commodity,quantity,specifications,packing,unit price,price terms,etc.

8.Transportation clause including the port of shipment,the port of destination,the time of shipment,whether allowing partial shipments or transshipment.

9.Stipulations relating to the draft.

10.Stipulations concerning the shipping documents required.

11.Certain special clauses if any.e.g.restrictions on the carrying vessel and the route.

12.Instructions to the negotiating bank.

13.The seal or signature of the opening bank.

14.Whether the credit follows“the uniform customs and practice for documentary credit’.

Parties involved

The Applicant for the Credit(开证人).Applicant is the party who applies for the opening of a letter of credit.

申请开立信用证的人为开证人,国际贸易中开证人通常为买方(Applicant/Principal/ Accountee/Accreditor/Opener)。信用证中用的词汇和词组常常是:

At the request of... 应……的请求

By order of... 按……的指示

For account of... 由……付款

At the request of and for... 应……的请求

Account of... 并由……付款

By order of and for account of... 按……的指示并由……付款

Beneficiary(受益人).Beneficiary is the party in whose favor the letter of credit is issued,and who is entitled to receive the payment,that is,the exporter.

受益人是指信用证中所制定的有权接受货款的人,即出口方。信用证中常见的词汇或词组有:

Beneficiary 受益人

In favour of... 以……为受益人

In your favour... 以你方为受益人

Transferor... 转让人(可转让信用证的第一受益人)

Transferee 受让人(可转让信用证的第二受益人)

Opening Bank/Issuing Bank/Establishing Bank(开证行).Opening bank is the bank located in the importer’s country that opens the letter of credit on behalf of the importer.By issuing a credit,the bank assumes full responsibility for payment after the proper draft and documents have been presented.

开证银行是指接受开证申请人的委托开立信用证的进口方所在地的银行。银行开出信用证,就意味着该银行要承担在合适的汇票和单据被出示后付款的责任。

在信用证中常见的词汇和词组有:Opening Bank,Issuing Bank,Establishing Bank

Advising Bank/Notifying Bank(通知行).Advising bank is the bank located in the exporter’s country who informs the exporter that a letter of credit have been opened in his favor and transfers the L/C to the exporter.It is usually the correspondent of the issuing bank.

通知银行是指接受开证行的委托,通知出口方信用证已开出并将信用证转交出口人的银行。该银行通常是开证行的代理行。

Negotiation Bank/Honoring Bank(议付行).Negotiating bank is the bank who buys an exporter’s draft submitted to it under a letter of credit and then forwards the draft and documents to the opening bank for reimbursement.Usually the advising bank is also the negotiation bank.

议付银行指买入出口人交来的跟单汇票并将汇票和单据寄送进口地开证行以索回款项的银行。通常通知行也就是议付行。

Paying Bank/Drawee Bank(付款行).Paying bank is the bank that makes payment to the beneficiary against presentation of stipulated documents.It is usually the opening bank but can also be a third designed bank.

付款行即在所规定的单据被出示时向受益人付款的银行。付款行一般就开证行,当然也可能是被指定的第三家银行。

Reimbursing Bank(偿付行),通常为开证行本身,负责向议付偿还依附行预先垫付的货款。

Confirming Bank(保兑行),即对开证行所开立的信用证进行保兑的银行。国际贸易中,通常以通知行作为保兑行。

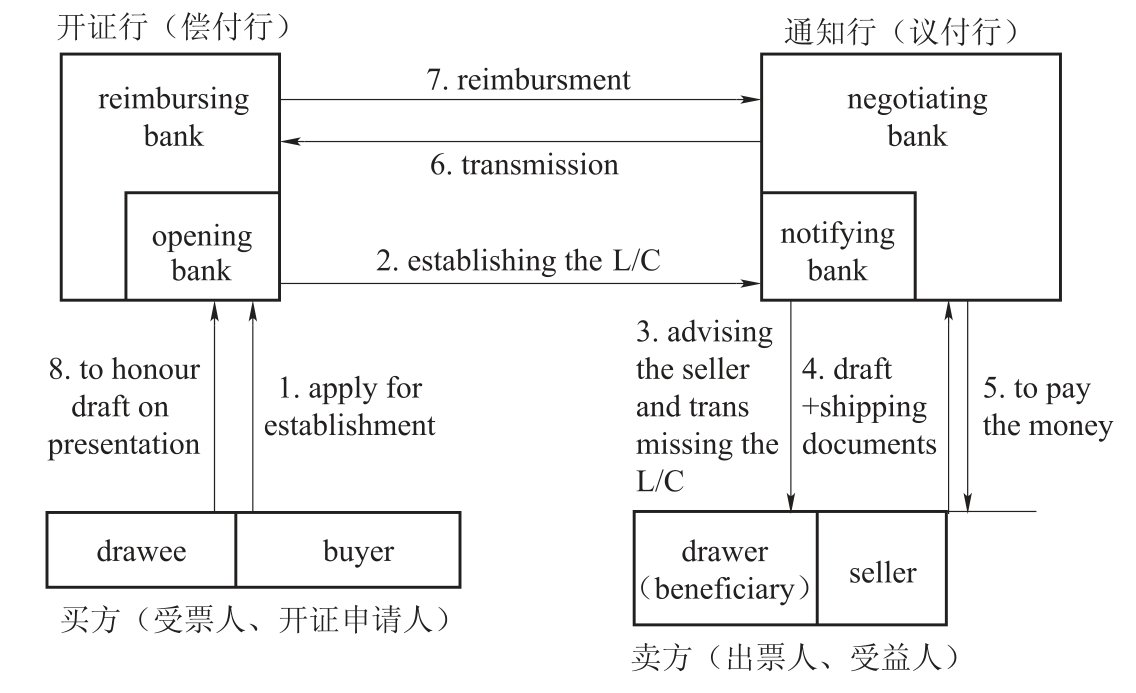

Flowchart

1.Apply for establishment(申请开证)

2.Establishing the L/C(开证)

3.Advising the seller and transferring the L/C(通知出口方转递信用证)

4.Draft + Shipping documents(卖方开汇票提交货物单据)

5.To pay the money(议付行垫付货物)

6.Transmission(转递)

7.Reimbursement(偿付)

8.To honour draft on presentation(付款赎单)

一、信用证中常见的议付有效期和到期地点的描述

1.直接写明到期日和到期地点名称

Expiry date:Mar.7,2004 in the country of the beneficiary for negotiation.

此信用证的有效期:2004年3月7日前,在受益人国家议付有效。

Expiry date:May 6,2004 Place CHINA.

信用证到期日:2004年5月6日,地点:中国

This credit remains valid/force/good in China until Mar.8,2004 inclusive.

本信用证在中国限至2004年3月8日前有效(最后一天包括在内)。

Drafts must be presented to the negotiating(or drawee)bank not later than Oct.10,2004.

汇票不得迟于2004年10月10日议付。

This Letter of Credit is valid for negotiation in China until Oct.16,2004.

本信用证于2004年10月16日止在中国议付有效。

Expiry date Jul.17,2004 in the country of the beneficiary unless otherwise stated.

除非信用证另有规定,本证于2004年7月17日在受益人国家到期。

Drafts drawn under this credit must be negotiated in China on or before Sep.3,2004 after which date this credit expires.

凭本证项下开具的汇票要在2004年9月3日或该日以前在中国议付,该日以后本证失效。

This credit is available for negotiation or payment abroad until Nov.17,2004.

此证在国外议付或付款的日期到2004年11月17日。

This credit shall remain in force until Oct.10,2004 in China.

此证到2004年10月10日为止在中国有效。

2.以“交单日期”、“汇票日期”等来表达信用证的有效期限

This credit shall cease to be available for negotiation of beneficiary’s drafts after Mar.8,2004.

本信用证受益人的汇票在2004年3月8日前议付有效。

Bill of exchange must be negotiated within 15 days from the date of Bill of Lading but not later than May 5,2004.

汇票须自提单日期起15天内议付,但不得迟于2004年5月6日。

Negotiation must be on or before the 15th day of shipment.

自装船日起15天或之前议付。

Documents must be presented for negotiation within 10 days after shipment date.

单据须在装船后10天内提示议付。

Documents to be presented to negotiation bank within 15 days after shipment effected.

单据须在装船后15天内交给银行议付。

二、信用证的金额和币制(Amount and Currency of Credit)的表述

信用证的金额和币制是信用证的核心内容,在信用证中的表达方式大致相似:

Amount USD2 000.00 金额,美元2 000.00元

For an amount USD________ 美元金额________元

A sum not exceeding total of USD________ 总金额不超过________美元

Up to an aggregate amount of USD________ 总金额________美元

三、信用证中常见的汇票条款

1.This credit is available with any Bank in China by negotiation drafts at sight Drawee Hong Kong and Shanghai Banking Corporation Ltd,London.

此信用证在中国境内任何银行议付有效,即期汇票,以香港上海汇丰银行伦敦分行作为付款人。

2.All drafts drawn under this credit must contain the clause:“Drawn under Bank of China,Paris credit No.198393 dated May 15th,2004”.

所有凭本信用证开具的汇票,均须包括本条款:“(本汇票)凭巴黎中国银行2004年5月15日所开出第198393号信用证开具”。

3.Drafts are to be drawn induplicate to our order bearing the clause “Drawn under Bank of China,Singapore Irrevocable Letter of Credit No.194956 dated Jul.17,2003”.

汇票一式二份,以我行为抬头,并注明“根据中国银行新加坡分行2003年7月17日第194956号不可撤销信用证项下开立”。

4.Drafts drawn under this credit must be presented for negotiation in Hangzhou,China on or before Jun.25,2004.

凭本信用证开具的汇票须于2004年6月25日前(包括25日这一天在内)在中国杭州提交议付。

5.Drafts are to be drawn under this credit to be marked“Drawn under Bank of China,New York L/C No.1956717 dated May 6,2004

根据本证开出的汇票须注明“凭中国银行纽约分行2004年5月6日第1956717号不可撤销信用证项下开立”。

6.Drafts in duplicate at sight bearing the clauses“Drawn under Bank of China,Hongkong L/C No.198393 dated Jul.17,2004”.

即期汇票一式二份,注明“根据中国银行香港分行信用证198393号,日期2004年7月17日开具”。

7.Drafts bearing the clause“Drawn under documentary credit No.19181117 of Bank of China,Dubai Branch”.

汇票注明“根据中国银行迪拜分行跟单信用证第19181117号项下开立”。

填写汇票时一般要注意的事项是:

汇票金额不能超过信用证规定的金额,如果信用证金额前有“大约”(ABOUT、CIRCA)或类似意义的词语(如 APPROXIMATELY)时,应解释为信用证允许有不得超过10%的增减幅度。

例如:信用证规定ABOUT USD10 000.00,则交来的汇票金额不得超过USD11 000.00,也不能低于USD9 000.00。

四、信用证中货物描述(Description of Goods)的文句

信用证中货物描述栏里的内容一般包括货名、品质、数量、单价、价格术语等。

装运港交货的三个术语最常用:CIF、CFR、FOB。还有FCA、CIP、CPT等等也常在信用证和合同中出现。

五、信用证中单据条款(Clauses on Documents)的描述

信用证项下要求提交的单据多种多样,但是通常信用证要求的单据有如下几种:

1.汇票(Bill of Exchange);

2.商业发票(Commercial Invoice);

3.原产地证书(Certificate of Origin);

4.提单(Bill of Lading);

5.保单(Insurance Policy);

6.检验证书(Inspection Certificate);

7.受益人证明书(Beneficiary’s certificate);

8.装箱单(Packing List)或重量单(Weight list)等等。

信用证中常见的要求提供单据的条款一般是这样打的:

Documents required as following

须提交以下单据。

Documents marked“X”below

须提交下列注有“X”标志的单据。

Drafts must be accompanied by the following documents marked“X”

汇票须随附下列注有“X”标志的单据。

...available against surrender of the following documents bearing the credit number and the full

议付时以提交下列注明本信用证编号及开证人详细姓名、地址的各项单据为有效。

单据要求提交的份数,一般有这样表示的:“in duplicate”,解释为“一式二份”,以下类推(triplicate,quadruplicate,quintuplicate,sextuplicate,septuplicate,octuplicate,nonuplicate,decuplicate)。

例如:Signed Commercial Invoice in duplicate.签字商业发票一式二份。

六、信用证中“装运条款”(Clauses on Shipment)的表述词语

信用证中显示的装运条款通常包括装运期限、是否允许分批和转运以及起讫地点的规定。

1.装运期(Date of Shipment)

根据《UCP600》规则的规定,如使用“于或约于”之类词语限定装运日期,银行视为在所述日期前后各5天内装运,起讫日包括在内。信用证中常见的装运条款一般有:Shipment from Chinese port to New York not later than Mar.8,2004.

自中国口岸装运货物驶往纽约,不得迟于2004年3月 8日。

Shipment must be effected not later than May 6,2004.

货物不得迟于2004年5月6日。

Bill of Lading must be dated not before the date of this credit and no later than Jul.17,2004.

提单日期不得早于本信用证开具日期,但不得迟于2004年7月17日。

Shipment from Chinese main port for transshipment to Osaka,Japan.

自中国主要港运往日本大阪。

Loading in charge:Shanghai China for transport to Dublin,Ireland,latest date of shipment Sep.3,2004.

由中国上海装运至爱尔兰都柏林,最迟装运日期为2004年9月3日。

也有的信用证上只是简单打上:Latest date of shipment:Mar.8,2004.

最迟装运日期:2004年3月8日。

Shipment to be effected from China for transportation to Colombo,Sri Lanka not later than May 6,2004.

从中国装运到斯里兰卡科伦坡不得迟于2004年5月6日。

2.分批/转运条款(Partial Shipments/Transshipment)

根据《UCP600》规定,除非信用证另有规定,允许分批装运、分批支款,也允许转运。运输单据表面注明货物系使用同一运输工具并经同一路线运输的,即使每套运输单据注明的装运日期不同,只要运输单据注明的目的地相同,也不视为分批装运。

信用证中常见的分批/转运条款有:

Partial shipments are allowed and transshipment is allowed.

分批装运和转运是被允许的。

Transshipment and Partial shipment prohibited.

不允许分装运和转运。

Partial shipment is allowed and transshipment is authorized at Hongkong only.

分批装运允许,转运仅允许在香港。

Shipment from Shanghai to Singapore without partial shipment/transshipment.

从上海装运到新加坡,不允许分批/转运。

Transshipment is allowed provided“Through Bill of Lading”are presented.

如提交联运提单,转运允许。

七、信用证中“特别条款”(Special Clauses/Conditions)的表述

信用证中的特别条款主要是依据银行和买卖双方交易的具体需要,以及进口国的政治经济和贸易政策等的变化而定的。常见的条款有:

1.议付与索偿条款(Negotiation and Reimbursement)

议付和索偿条款一般是开证银行对于议付行的指示,但是也涉及到各方的利益,常见的条款有:

At maturity,we shall pay to the negotiating bank as instructed by T/T for documents which are in compliance with credit terms and conditions.Telex charges are for account of beneficiary.

单证严格相符,到期日,我行将用电汇方式偿付贵行,此电报费由受益人承担。

In reimbursement,please drawn on our Head Office account with your London office.

偿付办法:请从我总行在贵行伦敦分行的账户内支取。

You are authorized to reimburse yourself for the amount of your negotiation by drawing as per arrangement on our account with Standard Chartered Bank London.

兹授权贵行索偿议付金额,按约定办法,请向标准渣打银行伦敦分行我账户内支取。

Negotiating bank may claim reimbursement by T/T on the Bank of China New York branch certifying that the credit terms have been complied with.

议付行证明本信用证条款已履行,可按电汇索偿条款向中国银行纽约分行索回货款。

2.佣金/折扣条款(Commission and discount)

信用证中常常有佣金和折扣条款,其表现形式各不一样,有的称为明佣,有的称之为暗佣,在信用证中的表示经常是这样的:

Signed commercial invoice must show 5% commission.

签署商业发票须显示5%的佣金。

Beneficiary’s drafts are to be made out for 95% of invoice value.being 5% commission payable to credit opener.

受益人的汇票按发票金额的95%开具,5%作为佣金付给受益人。

5% commission to be deducted from the invoice value.

5%佣金须在发票金额中扣除。

At the time of negotiation,you will be paid less 5%,being commission payable to M/S________ and this should be incorporated on the bank’s covering schedule.

在银行议付时,须扣除5%的金额作为付给某先生/女士的佣金,此佣金应填入议付银行的面函。

Drafts to be drawn for full value less5% commission,invoice to show full value.

汇票按CIF总金额减少5%开具,发票须表明CIF的全部金额。

Less 5% commission to be shown on separate statement only.

5%的佣金用单独的声明书列出。

The price quoted include a discount of 5% which must be shown on your final invoice,but is to be the subject of a separate credit note,the amount of which is to be deducted from your drafts.

信用证所列价格包括5%折扣在内,最后发票应开列未扣除5%折扣的价格,但须另出一份扣佣通知书,汇票金额则扣除此项折扣金额。

3.费用条款(Charges)

信用证上一般都列有费用条款,多数信用证规定,开证行的费用由开证人负担,开证国(地区)以外的银行费用由受益人承担。

All banking charges outside Korea and reimbursing charges are for account of beneficiary.

所有韩国以外的费用及偿付行费用由受益人承担。

All your commission and charges are for beneficiaries’ account including reimbursement bank payment commission and charges.

所有你方的费用及佣金由受益人承担,包括偿付行的费用在内。

Charges must be claimed either as they arise or in no circumstances later than the date of negotiation.

一切费用须于发生时或不迟于议付期索偿。

Port congestion surcharges,if any,at the time of shipment is for opener’s account.

装运时如产生港口拥挤费,须由开证人承担。

All banking charges outside of opening bank are for beneficiary’s account.

开证行以外的所有银行费用由受益人承担。

4.其他条款(Other Clauses)

1)运输单据(Transport Documents):主要是海运提单(Bill of Lading)和航空货运单(Airway Bill)。一般来说,客户会要求“clean/shipped on board”提单,以保证货物完好无损,并已经装船。常用的提单术语有:

Ocean Bill of Lading(B/L) 海运提单

On Board,Shipped B/L 已装船提单

Received for Shipment B/L 备用提单

Clean B/L 清洁提单

Unclean B/L,Foul B/L 不清洁提单

Straight B/L 记名提单

Bearer B/L 不记名提单,来人抬头提单

Order B/L 指示提单

Direct B/L 直达提单

Transshipment B/L 转船提单

Through B/L 联合运输提单

Stale B/L 过期提单

On Deck B/L 甲板提单,舱面提单

2)保险单(Insurance Policy):卖方根据信用证的规定,确定具体的保险公司、险别、保险金额等。例如:该信用证要求“提供两份保险金额为发票的110%的保“A”条例险的保险单/证明,背面背书,并声明在xxx地按照汇票的币种进行赔付。(Insurance Policy or certificate in duplicate endorsed in blank for full invoice value plus 10 pet with claim payable in x)Ⅸ(place)in the same currency as the draft covering Institute cargo Clause)

常用的保险险别和条款术语有:

China Insurance Clause中国保险条款

Institute Cargo Clause伦敦保险学会条款

Ocean Marine Cargo Clauses海洋运输货物保险条款

Free From Particular Average(F.P.A.)平安险

With Average/With Particular Average(W.A./W.P.A)水渍险

All Risks一切险

Additional Risks 附加险

3)商业发票(Commercial Invoice):卖方开具的商业发票也要与信用证上的规定相符,特别是商品名称、数量和金额。

如:“提供手签发票7份,要求注明FOB总值,运费、保费、CIF总值,并注明信用证号码。”(Manually signed commercial Invoice in 7 copies stating FOB value,freight charges,insurance premium separately,total CIF value and this L/C number.)

4)商品检验证书(Inspection Certificate)和原产地证明(Certificate Of Origin):这两项并不是必须具备的单据,卖方可以根据信用证上的具体条款出具,如没有要求,可不提供。其中常出现在原产地证明上的条款和术语有:

Certificate of Chinese Origin 国产地证明书

Certificate of Origin 产地证

Shipment of goods of…origin prohibited 不允许装运……的产品

Declaration of origin 产地证明书(产地证明)

certificate of origin “Form A”格式A产地证明书

Generalized System of Preference Certificate 普惠制产地证明书

5)装箱单和重量单(Packing List and Weight Memo)

在装箱单和重量单上,常见到的信用证条款和术语有:

Packing List detailing the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单

Packing List detailing 详注……的装箱单

Weight Notes 磅码单(重量单)

Detailed Weight 明细重量单

Weight and Measurement List 重量和尺码单

If the documents presented with any discrepancies from beneficiary to your good bank or we find any discrepancies when we received the documents we will claim USD50.00 for each discrepant.

如果提示的单据中有受益人和你方银行的不符点,或者我们收到单据后发现任何不符之处,每一不符点,我们将扣除50美元。

If the terms and conditions of this credit are not acceptable to you,please contact the openers for necessary amendments.

如你方不接受本信用证条款,请与开证人联系以作必要修改。

Documents to be presented within 15 days after shipment date but within the validity of the credit.

单据于装运日期后15天内提示银行,但必须在信用证的有效期内。

Shipping documents issued by following shipping companies are not acceptable.

由以下船公司出的运输单据是不能接受的。

Negotiation of this credit is restricted to yourselves.

本信用证限制于你行议付(指通知行)。

All documents except Bill of Lading should show this L/C number and date.

除了提单外的所有单据都须显示信用证号码和日期。

Credit Number,full name and address of the opener and notify party have to be mentioned on all documents.

信用证号码、开证人的全称和地址及通知人须打在所有单据上。

This Letter of Credit is transferable in China only,in the event of a transfer,a letter from the first beneficiary must accompany the documents for negotiation.

本信用证仅允许在中国转让,如有转让,第一受益人须有书面转让文书连同单据一起议付。

Both quantity and amount for each item 10% more or less are allowed.

每一项目的数量和金额均允许有10%的增减。

In case discrepant documents are presented,we shall deduct USD55.00 for each discrepant.

如提示不符单据,每一不符点,我行将扣除55美元。

八、开证行“保证条款”(Warranties of Issuing Bank)的表述

开证行的保证条款,在信用证中常见的表现形式有:

We hereby undertake all drafts drawn under and in compliance with the terms and conditions of this letter of credit will be duly honoured on presentation at this office.

凡按本信用证所列条款开具并提示的汇票,我行保证承兑。

We hereby engage with drawers and/or bona fide holder that drafts drawn and negotiated on presentation and that drafts accepted within the terms of this credit will be duly honoured.

兹对出票人及/或善意持票人保证,凡按本信用证开具及议付的汇票一经提交即予承兑;凡依本证条款承兑之汇票,到期即予照付。

九、跟单信用证统一惯例文句在信用证中的表示文句

Except as otherwise expressly stated herein,this credit is subject to the Uniform Customs and Practice for Documentary credits UCP(1993 Revision)International Chamber of Commerce Publication No,600.

除非另有规定外,本信用证根据国际商会1993年修订本第600号出版物“跟单信用证统一惯例”办理。

第二节 信用证英语的语言特点及翻译

信用证英语属专门用途英语(English for Specific Purposes,简称为ESP),具有法律文本的一般特点:行文严谨,用词准确、规范、正式,专业性强。

一、信用证的词汇特征及翻译

1.信用证常使用专业术语

信用证里大量使用专业术语,包括一些在函电里所使用的缩略语。外贸行业所使用的专门术语,不了解外贸业务的人很难准确地理解它的确切含义。如:

bona fide holder 善意持有人(议付行向受益人垫付资金、买入跟单汇票后,即成为汇票持有人,也就是善意持有人。)

neutral document 中性单据(指不表现出口商名称的单据)

……等等

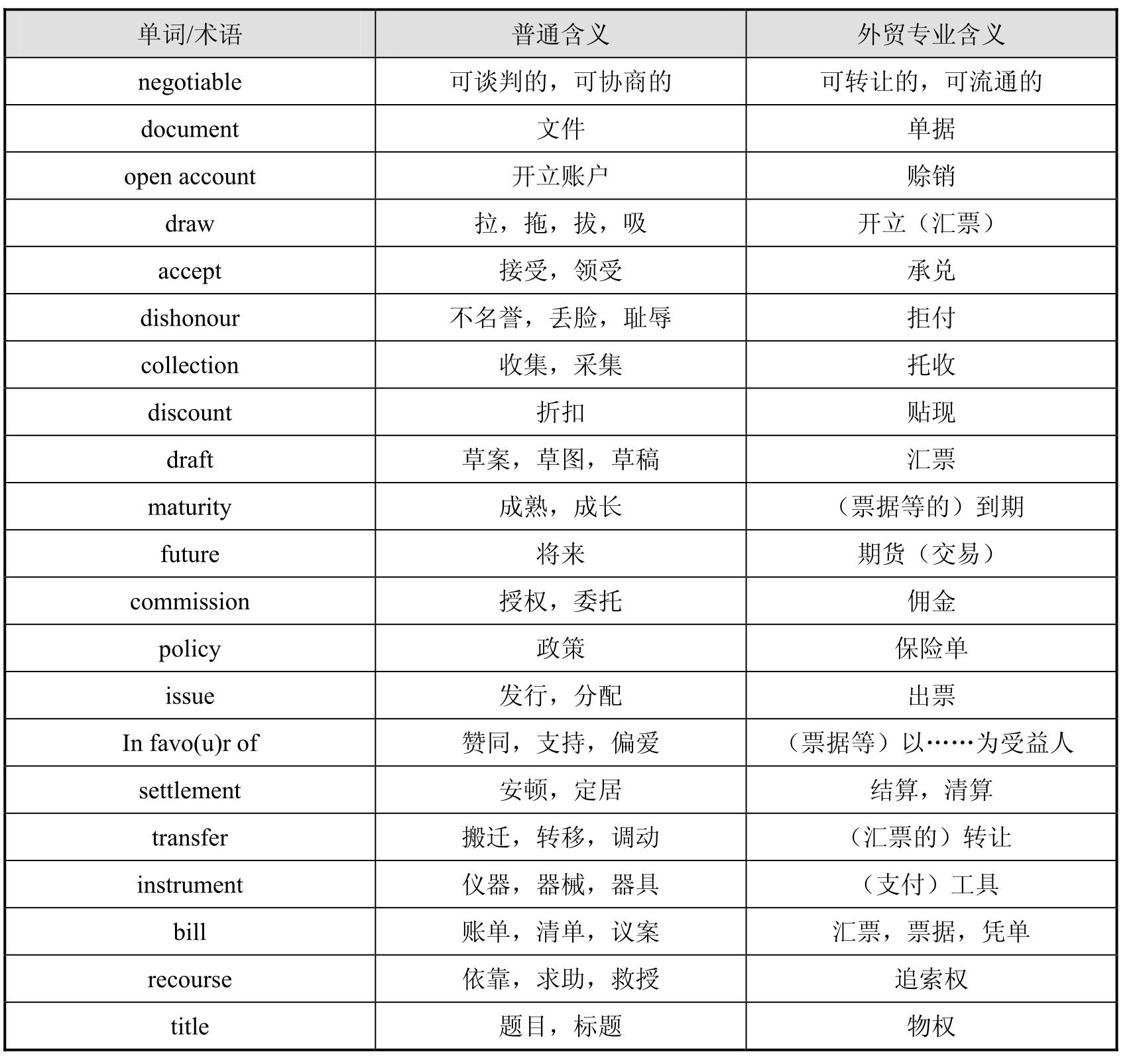

下面是一些常用单词和专业术语的词义转义比较:

2.某些多义词在信用证中的特殊含义

例如:All bank charges outside U.K.are for our principals’ account,but must claimed at the time of presentation of documents.

在英国境外发生的所有银行费用,应由开证人负担,但必须在提交单据时索取。

这里的principal 不是“首长”,“主要的”之意,而是指开证申请人。

Upon receipt of complaint documents,we undertake to remit proceeds by telegraphic transfer in terms of your instructions.

当收到该证项下相符的单据时,我(开证行)保证在两个工作日内按贵行指令付款。

“proceeds”这里是“款项”之意,而不是指“前进”;“acceptance” 不是“接受”之意,而是“承兑”,即远期汇票的付款人明确表示同意按出票人的指示,于票据到期日付款给持票人的行为。

再如:Drawee bank’s charges and acceptance commission are for buyer’s account.

付款行的费用和承兑费用由卖方负担。

“collect”一词在信用证中出现,不是“收集”,而是“到付”的含义。“freight collected”即“运费到付”。

3.介词短语的使用

信用证常使用简单的介词结构取代从句来表达复杂的含义,体现出这种文本简洁、正式的特点。翻译时可将从句结构表达出来。

“against”一词在信用证中出现的频率很高,而其在信用证中的词义与在普通英语中完全不同。在普通英语中,against是介词,可以表示“反对”,“碰撞”,“紧靠”等意思。但在信用证中,against一词用来表示“凭……”,“以……”,它在信用证中的词义在一般的字典中并没有出现。如:

This credit is valid until November 20,2003 in New York for payment available against the presentation of the following documents.

本信用证在2003年11月20日在纽约到期前,凭提交以下单据付款。

再举几个类似例子:

Upon presentation of the documents to us,we shall authorize your head office backing department by airmail to debit the proceeds to our foreign business department account.

一俟向我行提交单证,我行将用航空邮件授权你总行借记我行国外营业部账户。

On receipt of the required documents which comply with the terms of this credit,we will remit proceeds in accordance with your instructions.

当收到该证项下相符的单据时,我(开证行)将按贵行指令付保证金。

Documents must be negotiated in conformity with the credit terms.

与该证相符的单据须议付。

4.古体词语使用较多

古体词语主要是here,there加上介词构成的复合词。如:hereby=by means of(以此方式,特此),herein=in this document(此中,在此文件中),thereby=by that means(因此;在那方),therein=in that;in that particular(在那里;在那点上)……这些词语的使用可避免一些不必要的重复,同时可以使文体显得正式,庄重。如:

We hereby engage that all drafts drawn under and documents presented hereunder will be duly honored by us provided that the terms and conditions of the credit are complied with.

我行保证凭符合本信用证之汇票及单据付款。

5.分数、数字、日期表达的正确理解与翻译

份数:

in duplicate 一式两份;

in triplicate 一式三份;

in quadruplicate 一式四份;

in quintuplicate 一式五份;

in sextuplicate 一式六份;

in septuplicate 一式七份;

in octuplicate 一式八份;

in nonuplicate 一式九份;

in decuplicate 一式十份

数字:

1/3 original B/L must be sent to the opener by airmail.

三份正本提单中的一份必须通过航空件寄给开证人。

日期:

a.如果装船日期为:在某月某日之后,和在某月某日之前,应使用after和before。如:6月25日之后,7月10日之前装船。应译为:Shipment will be effected after the 25th of June and before the 10th of July.在此,after和before应理解为不包括所提到的日期。即6月25日和7月10日装船是错误的。

b.如果装船期为:到某月某日止,从某月某日,直到某月某日等词,用to,from,until。使用这些词时,应理解为包括所提到的日期。如:Time of shipment:from 10th to 20th August.10日合法20日都包括在内。

c.如果装船期规定为:最晚不迟于9月30日,一般表述为:Latest date of shipment:30 September.

二、L/C中长句的特点及翻译

信用证中多长句,这也是信用证作为法律文体的一种特点。长句中从句修饰成分较多,结构较复杂,大多是复合句,并很少使用标点符号。这种一气呵成,结构复杂的长句使信用证文体显得庄重严谨,以免双方产生误解和纠纷。在翻译时,必须正确理解句子主干与它的修饰成分,不能把连贯的意思拆开来译,否则会造成错误的理解。如:

We hereby agree with the drawers,endorsers and bona-fide holders of the drafts drawn under and in compliance with the terms of this credit that such drafts shall be duly honored on due presentation and delivery of documents as herein specified.

凡根据本信用证并按其所列条款而开具的汇票向我行提示并交出本证规定的单据者,我行同意对其出票人、背书人及善意持有人履行付款义务。

分析:这是开证行在自由议付信用证中加列的保证文句。该句agree with...of中,drawers,endorsers and bona-fide holders 是并列成分,为agree with的宾语;而drafts drawn under and in compliance with the terms of this credit为of的宾语。然后要分析清楚that such drafts...是agree的宾语从句,表述开证行履行付款义务的条件。

1.省略系动词和助动词“be”

1)省略系动词be

例1:

a.Signed Commercial Invoice in three fold(商业发票一式三份)

b.Marine Insurance Policy in duplicate(海运保险单一式两份)

c.Packing list in five fold(装箱单一式五份)

例2:

a.Latest date of shipment 080523(最迟装运期为08年5月23日)

b.Latest date of shipment:FEB 28,2008(最迟装运期是08年2月28日)

c.Shipment from Dalian to Hamburg(从大连运往汉堡或装运港是大连,目的港是汉堡)

分析:在对这些省略系动词的句子进行汉译时,首先要做到意义准确无误,然后考虑汉语行文的需要。如果需要的话,可以加上“是”,“为”,使行文更符合汉语习惯(见例2的汉译);如果没有必要,则可不译(见例1的汉译)。

2)省略助动词be

例3:

a.Each document to be dated not later than B/L date.

(所有单据的出单日期应不晚于提单日期)

b.Documents to be presented 15 days after the date of shipment.

(单据需在装运日后15天内交银行)

c.All shipping documents to be sent direct to the opening office by registered airmail in two lots.

(所有装运单据应以航空挂号信的形式分两次直接寄至开证行)

d.Insurance to be effected by buyer.

(保险由买方办理)

例4:

e.Invoice to show H.S.Code of Commodity Number of the Merchandise.

(发票需显示商品的海关税则号)

f.If Shipment in Container,Bill of Lading to evidence Container Number and Seal Number.

(如果货物采用集装箱装运,提单应显示集装箱号和铅封号)

例5:

g.Partial shipment allowed.(分批装运允许)

Transshipment prohibited.(转船不允许)

h.Partial shipments:allowed.(分批装运允许)

Transshipment:not allowed.(转船不允许)

分析:例3和例4中的几个条款都是信用证中有关单据要求的实例,都省略了助动词“be”。例3采用的是“be to be done”(表示将来) 的结构。其中a句规定了单据的出单日期,b句规定了向银行交单的期限,c句规定了向开证行寄单的办法,d句则规定了保险由买方办理,暗含的意思是保险单由买方出具,卖方无需办理。例4采用的是“be to do”的结构,省略了助动词“be”。其中e句规定了发票上需要额外显示的信息,属于信用证中的特殊要求,要照办。所有句子都省略了助动词be,句式虽然简洁,但不会引起任何歧义。

在对这些省略助动词的句子进行翻译时,准确容易做到,主要需考虑汉语行文的要求,做到规范、通顺、易懂。句中省略的“be”不必译出,而其后的to do 和to be done的翻译则可以同汉语的“应”,“需”,“由”这一类词相对应。例5属于被动语态省去助动词be,主要用在运输条款中。有关可否分批和转船的规定无非是“允许”、“不允许”和“禁止”三种情形。无论哪种情形,都习惯上省略助动词“be”,言简意赅,清楚明了,翻译时可采用直译的方法。

2.状语从句在L/C中的使用

在信用证中,需要阐明权利和义务时,必须要明确指出在什么情况下,什么时间和地点,以何种方式进行什么行动,因而会使用较多的时间、地点、方式和条件等状语。信用证中用来引导条件句的词语主要有:if;only if;in case of,provided;providing that等。

英语中各种状语的位置非常灵活,可以位于句首,句末或句中。而汉语中则通常将表示假设的条件状语从句放在句首。一般情况下,在翻译信用证中的这类句子时,可以首先考虑将状语的位置移到句首,从而使句子的核心部分突出,而且使其结构简化。如:

1)Transshipment is allowed on condition that the entire voyage be covered by through B/L.

只有在整个运输途中都出示提货单的情况下才允许转船运输。

2)This L/C will be duly honored only if the seller submits whole set of documents that all terms and requirements under L/C NO.45673 have been complied with.

只有出口人提供与信用证No.45673号项下相符的全套单据,本行才予以承付。

3)Unless a nominated bank is the confirming bank,The authorization to honor or negotiate does not impose any obligation on that nominated bank to honor or negotiate,except when expressly agreed to by that nominated bank and communicated to the beneficiary.

除非一家被指定银行是保兑行,对被指定银行进行兑付或议付的授权并不构成其必须兑付或议付的义务,被指定银行明确同意并照此通知受益人的情形除外。

4)If the bill of lading contains the indication “intended vessel”or similar qualification in relation to the name of the vessel,an on board notation indicating the date of shipment and the name of the actual vessel is required.

如果提单包含”预期船”字样或类似有关限定船只的词语时,装上具名船只必须由注明装运日期以及实际装运船只名称的装船批注来证实。

5)A transport document indicating that transshipment will or may take place is acceptable,even if the credit prohibits transshipment.

即使信用证禁止转运,银行也将接受注明转运将发生或可能发生的运输单据。

3.长短句并列使用

信用证出于对篇幅和格式的需要,有时往往限制字数,尽量避免长句的使用。而限制长句使用的办法之一就是使用简单介词来缩短句子结构。例如:

1)...Available with any bank by negotiation against the documents detailed herein and of your drafts at sight drawn on Bank of China.

凭本信用证所列单据和开给中国银行的即期汇票可以在任何一家银行议付。

此句用了六个介词,包含以下几层意思:

a.本信用证的议付地点(with)——any bank(任何一家银行)

b.本信用证的支付方式(by)——negotiation(议付)

c.本信用证的付款条件(against,of)——documents and drafts(凭单据和汇票)

d.本信用证的汇票期限(at)——sight(即期)

e.本信用证的付款人(on)——Bank of China(中国银行)

事物都有两面性,但有时为了使表达更加清楚严密,信用证中也会出现比较长的句子。

2)If a credit states that charges are for the account of the beneficiary and charges cannot be collected or deducted from proceeds,the issuing bank remains liable for payment of charges.

如果信用证规定费用由受益人负担,而该费用未能收取或从信用证款项中扣除,开证行依然承担支付此费用的责任。

3)We hereby engage with the drawers,endorsers and bona fide holders of drafts drawn under and in compliance with the terms of the credit that such drafts shall be duly honored on due presentation and delivery of documents as specified if drawn and negotiated within the validity date of this credit.

凡根据本信用证开具与本信用证条款相符的汇票,并能按时提交本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任,需在本证有效期内开具汇票并议付。

4)In reimbursement draw sight drafts in Pounds Sterling on Halifox Bank and forward them to our London Office,accompanied by your certificate that all terms of this letter of credit have been complied with.

偿付办法:由你方开出英镑即期汇票向哈里发银行支取。在寄送汇票给我伦敦办事处时,应随附你行证明,声明本证的全部条款已经履行。

4.分词短语作定语

大多出现在信用证中对单据的一般要求和特殊要求中。一般要求直接出现在所需单据(documents required)项下,而特殊要求则出现在特殊条款(additional conditions)项下。例如:

1)4 Signed invoices in the name of applicant certifying merchandise to be of China origin.(4份经签署的商业发票,以申请人为抬头,证明货物系中国原产。)

2)Copy of beneficiaries’ telex to buyer quoting L/C number mentioning details of shipment.(受益人的电传副本一份,显示信用证号码,注明装运细节。)

3)Beneficiaries’ certificate certifying that one set of N/N shipping documents has been sent to buyer immediately after shipment has been made.

(受益人证明一份,证明一套副本装运单据已经在装运后立即寄出。)

4)Marine insurance policy in triplicate endorsed in blank with claim payable in Japan in the currency of the draft covering 110 percent of the invoice value including institute warclauses institute cargo clauses(all risks) institute SRCC clauses.

(海运保险单一式三份,空白背书,按汇票的币别在日本进行索赔,按发票金额的110%投保,包括协会战争险,协会货物一切险和协会罢工暴动民变险。)

5)Full set of clean “shipped on board” ocean bill of lading drawn to the order of Commercial Bank Zurich,showing beneficiary as shipper marked notify applicant and us bearing our L/C No.showing freight Prepaid.Name,address and telephone numbers of shipping agent must also appear on bill of lading.

(全套清洁已装船海运提单,凭苏黎世商业银行指示,显示受益人为发货人,注明申请人和我行为被通知人,显示信用证号码,运费预付,以及船代理的名称、地址和电话号码。)

5.被动语态的使用

信用证要求突出动作的对象,而忽视动作的完成者,也就是说信用证的文体因素和语言环境要求强调客观事实,因而动词被动语态的出现率较高。例如:

1)You are requested to advise the credit to the beneficiary without adding your confirmation.

请贵方将此证通知受益人,而无需对该信用证加具保兑。

2)The number and the date of the credit and the name of our bank must be quoted on all drafts required.

请在所有汇票上注明该信用证号码、开证日期和我行名称。

3)All documents must be forwarded to us in one lot by special service courier.

(请将所有单据以特快专递一次寄至我方。)

分析:在对信用证中这类含有被动语态的句子进行汉译时,不宜使用汉语的“被”字句,因为这样会使汉语的行文不够流畅,如果上面的句子译成“你被要求将信用证……”和“……被注明在所有汇票上”和“所有单据需……被寄至我行”,译文欠通顺。正确的翻译方法是在汉语译文中不使用“被”字,而使用汉语的主动语态的形式。因为都是提出要求希望对方执行的句子,所以按照汉语的礼貌习惯,在所提的要求前加上“请”字,如“请通知”、“请注明”、和“请寄至”使语气大大缓和,有利于和谐贸易关系的建立和任务的执行,从而促进国际贸易的开展。

再举几个例子:

4)Drafts and documents are to be couriered in one lot to Bank of China,Shanghai Branch.

汇票和单据请一次寄单至中国银行上海分行。

5)Packing list in one original and 5 copies,all of which must manually signed.

装箱单一份正本五份副本,请所有必须手签。

6)All banking charges outside Japan are for account of beneficiary.

在日本境外发生的所有银行费用均由受益人负担。

免责声明:以上内容源自网络,版权归原作者所有,如有侵犯您的原创版权请告知,我们将尽快删除相关内容。