操作一 网上审证和改证

在以信用证支付条件成交的合同项下,买方及时开证是卖方履行合同的前提条件。因此,卖方在合同签订后,应及时了解并跟踪国外信用证的开立情况,如信用证未按时开到,应及时催促国外客户按时开证;如信用证按时开到,则根据销售合同条款及有关国际贸易惯例认真审核信用证内容;若发现其中有不符点或不利条款或违反国家有关政策的条款,应及时要求进口方修改,以保证合同的顺利履行和确保安全收汇。

一、主要业务环节

1.催开信用证

2.审核信用证

3.修改信用证

二、主要技能

1.拟写催证函

2.审核信用证

3.拟写改证函

催证的意义

读一读

在凭信用证支付的交易中,按时开立信用证是买方必须履行的最重要的义务。通常情况下,买方至少应在货物装运期前15~30天将信用证开到卖方。但在实际工作中,由于种种原因,如市场发生了不利变化或资金短缺时,往往会发生买方拖延开证或不按合同开证的情况。因此,我们应经常检查开证情况,催促对方及时开证,以保证按时履约,提高履约率。尤其是大宗交易或按买方要求特制的商品交易,更要结合备货情况及时进行催证,否则出口方无法组织货源。

三、操作指南

(一)催开信用证

1.须予催证的几种情况

催开信用证并非出口合同履行的必要环节。在实际工作中,通常在遇有以下情况时才有必要进行:

(1)合同规定的装运期较长时,我方应在通知对方预计装运期的同时催请对方按约定时间开证。

(2)根据我方备货和船舶情况有可能提前装运时,可商请对方提前开证。

(3)虽然开证期限未到,但发现国外买方资信不好或者市场情况有变时,也可催促买方开证。

(4)国外买方未在合同规定的期限内开证,我方可向对方要求损害赔偿;或催促对方开证;或限期对方开证;或在催证时保留索赔权。

催开信用证可通过信件、电报、电传、传真、E-mail等方式直接通知国外买方,必要时,可商请我国驻外机构或银行代为催证。

2.拟写催证函应注意事项

(1)写信的日期不能太早。

(2)写信的目的是要使买方尽快开来信用证以履行合约,因此要注意技巧。

3.催证函常用句型

(1) Referring to the 500 sets Children's Bicycles under our S/C No. 246,we would draw your attention to the fact that the date of delivery is drawing near,but we haven’t received your L/C.(关于我方第246号销售合同项下的500辆童车,我们拟提请你方注意,交货期临近,但我方未收到你方信用证。)

(2) The date of delivery is approaching,but we still have not received your covering L/C up to now.(交货期临近,而我们迄今仍未收到你方有关信用证。)

(3) With reference to our S/C No. 531,we regret to find that your L/C has failed to arrive here within the time stipulated.(关于我方第531号销售合同,我们很遗憾你方的信用证未能在规定的时间开达我方。)

(4) As the goods are ready for shipment,please expedite your L/C so that we may effect shipment by S.S.“Peace”.(由于货已备妥待运,请速开信用证以便这批货赶上“和平”号轮。)

(5) The goods under S/C No. 3672 have been ready for quite some time. Please have the L/C opened with the least possible delay.(第3672号销售合同项下的货物已备妥多时,请立即开立有关信用证。)

议一议

我方与某外商洽谈一笔出口交易,双方就合同的主要条件全部达成一致意见。我方在缮制合同时,因疏忽没有注明信用证的到证时间,正好在这时市场行情下跌,外商迟迟不开信用证。眼看装运期临近我方几次催证,对方始终没有答复。请问:

1.在此情况下,我方可否先发货,然后再继续催证?

2.我方如不发货,将会有何后果?

3.对方不开证是否违约?

4.如果你经手这笔业务,你将如何处理?

(6) Please do your utmost to open your L/C,so that we may execute your order smoothly.(请速开信用证以便这笔订货得以顺利执行。)

(7) Please establish the L/C in exact accordance with the terms of the contract as soon as possible.(请尽快严格按合同条款开信用证。)

(8) In order to avoid subsequent amendments,please see to it that the L/C stipulations are in exact accordance with the terms of the contract.(为了避免日后修改,务请做到信用证规定与合同条款完全一致。)

(二)审核信用证

1.审证的依据

(1)依据买卖合同审核信用证,要求做到“证同相符”;

(2)结合《跟单信用证统一惯例》(国际商会第600号出版物)及相关惯例的解释和规定,提高审证的正确率。

审证的意义

读一读

信用证是依据合同开立的,内容应与合同条款相一致。但在实践中,由于种种因素,往往会出现开立的信用证条款与合同规定不符。如由于工作的疏忽、电文传递的错误、贸易习惯的不同、市场行情的变化或买方有意利用开证的主动权加列对其有利的条款、个别商人甚至出于不可告人的目的在申请开证时故设陷阱等。为确保收汇安全和合同的顺利执行,防止导致经济上和政治上对卖方不应有的损失,卖方应该在国家对外政策的指导下,对不同地区、不同银行的来证进行认真的审核。

2.审证的要点

审证是银行与出口企业的共同责任。银行着重审核开证行的政治背景、资信能力、付款责任以及索汇路线等方面的内容;出口企业着重审核信用证的条款是否与买卖合同的条款规定相一致。一般应包括以下几个方面:

(1)对收证途径的审核。信用证可由开证行径寄受益人(卖方),也可交由开证申请人(买方)转寄或当面交给受益人(卖方)。凡未经通知行转递或通知的信用证,必须送银行审查,经证实认可后方能使用。

(2)对信用证本身的审核。主要审核L/C的种类、金额、付款期限、开证申请人、开证行、受益人、通知行等有关当事人的名称地址是否与合同一致,交单期、有效期是否能满足备货、装运和制单的需要,到期地点是否在出口国等。

(2)对装运条款的审核。主要审核装运时间、启运地(港)、目的地(港)以及关于分运和转运的规定是否与合同一致。

(3)对货物条款的审核。主要审核品名、规格、数量、包装、单价、总值、贸易术语是否与合同规定一致,金额、数量是否与溢短装规定相适应,含佣价是否要求扣除佣金等。

(4)对保险条款的审核。主要审核保险的责任是否与贸易术语相适应;保险险别、保险金额、保险加成是否与合同规定相一致。

(5)对单据条款的审核:主要审核单据的种类、份数、内容、填制要求是否符合贸易的一般做法和国际惯例的规定;要求提交的单据是否可能提供等。

(6)对信用证有效性的审核。主要审核信用证是否已生效;信用证中是否有保留或限制性条款;证内是否有开证行保证付款的文句;是否有适用《UPC600》的字样(由于SW IFT在其《用户指南》中对其所开信用证均适用《UCP600》已作明文规定,故SW IFT信用证中并无适用《UPC600》的字样)。

议一议

上海A贸易公司与香港金华企业签订了销往美国的1万立方米花岗岩合同,买方通过香港某银行按时开出了信用证。信用证中规定:“货物到达目的地并经主管当局检验合格后方可支付”,A公司并未对此条款提出异议。在此期间,国际市场上花岗岩的价格下跌。A公司按时装运、严格制单并及时交单结汇,但开证行以货物质量经主管当局检验不合格为由,拒绝付款,并提供了相应的检验证书。最后以A公司降价15%了结此案。

请问:我们应从此案中吸取什么教训?

(三)修改信用证

国外来证经审核无误,卖方即可按信用证条款发货、制单结汇。如经审核发现问题,则应区别问题的实质,分别同银行、运输、保险、检验检疫局等部门进行研究,做出恰当、妥善的处理。对于影响安全收汇的条款,必须通过改证加以解决。

1.改证的基本原则

(1)如信用证的规定宽于贸易合同的规定则无需修改,若严于贸易合同的规定则应视受益人的实际情况(能否做到)而定,如无法做到,应要求修改;

(2)改证内容应一次性提出,尽量避免由于我方考虑不周而多次提出修改要求;

(3)对于信用证修改通知书的内容只能全部接受或全部拒绝;

(4)信用证的修改可由卖方提出,也可由买方提出,但无论如何都必须通过开证行进行修改方为有效;

(5)必须坚持在收到银行修改通知书并经审核无误后才对外发货,以免发生货物已装运而修改通知书未到的情况,造成我方在工作上的被动和经济上的损失。

2.改证函的基本要求

(1)感谢对方通过开证行开来了信用证;

(2)列明信用证中的不符点、不能接受的条款,并说明如何改证;

(3)感谢对方的合作,并希望信用证修改通知书在××日之前开到,以利按时装运。

议一议

A公司与德国客户以CIF条件、信用证支付达成一笔罐头出口交易。德国客户按时开来信用证,在保险单据中规定:“CONFIRMATION ISSUED BY THE PEOPLE'S INSURANCE COMPANY OF CH INA,CONFIRM ING THAT THE MERCHANDISE WAS IN A GOOD AND SOUND CONDITION PRE-VOYAGE”。A公司认为商品品质应由出入境检验检疫局鉴定,与保险公司无关,不同意接受这一条款,要求客户修改。由于A公司认为要求改证的理由充分,客户肯定会修改,于是在没有接到修改通知书的情况下把货物装船出运,但在向银行提交单据一天后收到客户的修改书: DELETE THE WORD“PRE-VOYAGE”IN INSURANCE POLICY/CERTIFICATE,OTHER TERMS AND CONDITIONS REMAIN UNCHANGED。

请问A公司应该如何处理?我们应从中吸取什么教训?

3.改证函的常用句型

(1) Thank you for your L/C No.... issued by...(谢谢你方由……银行开立的……号信用证。)

(2) We are very pleased to receive your L/C No....(我们很高兴收到你方……号信用证。)

(3) However,we are sorry to find it contains the following discrepancies:(不过,我们遗憾地发现有下列不符点:)

(4) But the following points are in discrepancy with the stipulations of our S/C No....:(不过下列各点与……号销售合同的规定不相符:)

(5) Please amend... to read....(请将……改为……)

(6) Please insert the word(s)... before....(请在……前加上……词/句)。

(7) The expiry date should be... in steaed of....(到期日应是……而不是……。)

(8) Please delete the clause... and insert the wording....(请删去……条款,增加……字句。)

(9) Please extend the shipment date and the validity of the L/C to... and... respectively.(请将信用证装运期和有效期分别展至……和……。)

(10) Thank you for your kind cooperation. Please see to it that the L/C amendment reaches us before×××(date),failing which we shall not be able to effect punctual shipment.(谢谢你方的合作。请注意信用证修改书应在……日前到达我方,否则我们不能准时装运。)

四、模拟运作

(一)业务背景

10月23日,广东新天时有限公司收到客户回签合同函P74和回签的确认书一份(参见P 60),遂安排货物的包装及刷唛并验收入库。但直到10月底,公司仍未收到该客户的信用证。鉴于我方货已备妥,合同装运期临近,10月30日李明向科威特客户发出了催证函,提醒对方合同货物已备妥,要求对方按合同规定向其当地银行申请开证。

11月2日,我方收到科威特客户通过该国BURGAN银行开来的不可撤销跟单信用证。

【回签合同函】

October 23,20××

Dear Sirs,

We have duly received your Sales Confirmation No.STNT041088 covering 26 280 pairs of“AILY”Ladies'Shoes we have booked with you.Enclosed pleased find the duplicate with our counter-signature.Thanks to mutual efforts,we were able to bridge the price gap and put the deal through.

The relative L/C is to be established with our local bank in your favour.It will reach you in due course.

Yours faithfully,

James Brown&Sons

JOHN SM ITH

(二)操作指示

请你以广东新天时有限公司业务员李明的身份完成以下工作:

1.撰写催证函并向科威特客户发出,提醒对方按合同规定及时向我方开出信用证。

2.认真审核国外来证,如有与合同规定不符的内容或不利条款或违反国家有关政策的条款,应向对方发出改证函,指出信用证存在的问题并要求对方及时与银行联系修改。

【国外来证】

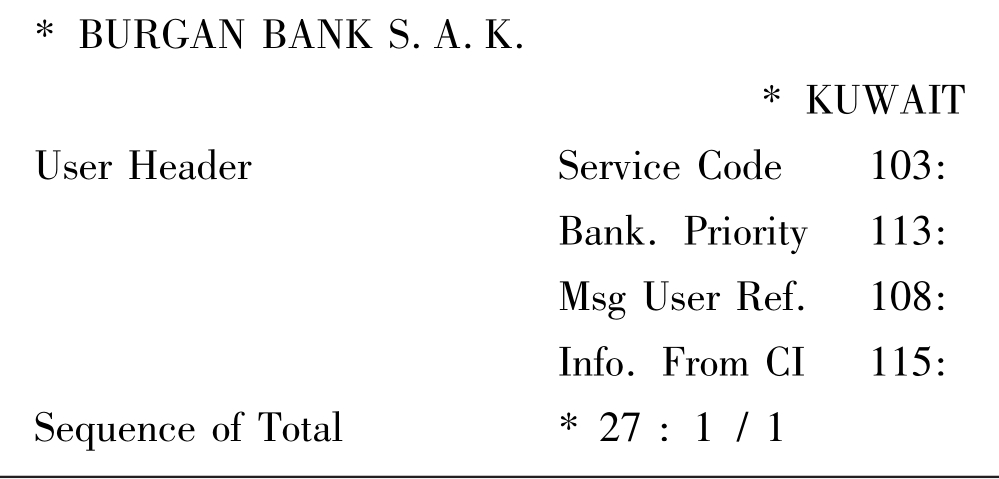

Logical terminal ST15

Issue of a Documentary Credit Page 001

Func STPRQ

MSGACK DWS765I Auth OK,key B1011216C8C097DA,BKCHCNBJ BRGNKWKW record318854

Basic Header F 01 BKCHCNBJA41A 062317309

Application Header 0700 0930 20326BRGNKWKWAXXX 4179 445719 020326 1430 N

Form of Doc.Credit * 40 A: IRREVOCABLE

Doc.Credit Number * 20: LCS220456024012

Date of Issue * 31 C: NOV.2,20××

Date&Place of Expiry * 31 D: DEC.2,20××,KUWAIT

Applicant Bank * 51 D: BURGAN BANK,KUWAIT

Applicant * 50: JAMES BROWN&SONS,KUWAIT

Beneficiary * 59: GUANGDONG NEW TIME CO.,LTD,

GUANGDONG,CH INA

Amount * 32 B: CURRENCY USD 58 384.80

Available with/by * 41D: BANK OF CH INA/ IN CH INA BY NEGOTIATION

Drafts at... 42 C: AT SIGHT

Drawee 42 D: BURGAN BANK,KUWA IT

Partial Shipments 43 P: ALLOWED

Transshipment 43 T: NOT ALLOWED

Loading in Charge 44 A: CH INA

For Transport to... 44 B: KUWA IT

Latest Date of Ship. 44 C: NOV.30,20××

Descript.of Goods 45 A: COVERING THE FOLLOW ING GOODS:

25 280 PAIRS OF LADIES'SLIPPERS

CIFC3 KUWA IT

ALL OTHER DETAILS ARE AS PER S/C NO.STNT041088 DATED OCTOBER 22,20xx.EACH PAIR MUST BE PRINTED W ITH THE NAME OF THE COUNTRY OF ORIGIN AS‘MADE IN CH INA’AND INVOICES MUST CERTIFY TO THIS EFFECT.

DOCUMENTS REQUIRED

1. BENEFICIARIES'SIGNED INVOICES IN TRIPLICATE SHOW ING:

A) NAME OF THE CARRY ING VESSEL.

B) ITEM NUMBER AS PER HARMONIC SYSTEM.

C) SEPARATELY THE PRICE AND NET WEIGHT(EXPRESSED IN KILOS) OF EACH TYPE OF GOODS.

D) NAME AND NATIONALITY OF THE MANUFACTURERS/ PROCESSORS/ PRODUCERS OF EACH ITEM OF MANUFACTURED OR PROCESSED GOODS..

E) CERTIFY THAT EACH PIECE/PACKING UNIT OF GOODS CARRIES A STAMP/ LABEL INDICATING THE NAME OF THE COUNTRY OF ORIGIN IN A NONDETACHABLE OR NON-ALTERABLE WAY.

2. CERTIFICATE OF ORIGIN IN DUPLICATE SIGNED BY THE CHAMBER OF COMMERCE AND/OR OFFICIAL TRADE AND/OR INDUSTRIES ASSOCIATION BEARING THEIR OFFICIAL SEAL AND STATING:

A) THE COUNTRY OF ORIGIN OF GOODS(IN THE EVENT OF SHIPMENT OF GOODS CONTAINING FOREIGN MATERIALS THE COUNTRY OF ORIGIN OF THESE FOREIGN MATERIALS MUST BE SHOWN ON THE CERT.OF ORIGIN).

B) NAME OF THE MANUFACTURERS/PROCESSORS FOR MANUFACTURED OR PROCESSED GOODS NAME OF THE EXPORTING COMPANY AND EXPORTING COUNTRY.IF A CERTIFICATE OF ORIGIN SHOW ING THE NAME OF THE MANUFACTURERS AND/OR PROCESSORS SIGNED BY A CHAMBER OF COMMERCE IS UNOBTAINABLE A SEPARATE STATEMENT ISSUED BY THE SH IPPER ON THEIR OWN RESPONSIBILITY,SHOW ING THE NAME OF THE MANUFACTURERS AND/OR PROCESSORS OF THE GOODS,THE RESPECTIVE INVOICE NUMBER AND CERT.OF ORIGIN SIGNED BY A CHAMBER OF COMMERCE SHOW ING THE ORIGIN OF THE GOODS IS ALSO PRESENTED.

3. PACKING LIST IN TRIPLICATE SHOW ING: DESCRIPTION OF GOODS,ITEM NUMBER AS PER HARMONIC SYSTEM,NUMBER OF PACK,KIND OF PACKAGE,CONTENTS OF PACKAGE,GROSS WEIGHT,NET WEIGHT AND TOTAL COST OF EACH ITEM.

4. COMPLETE SET OF NOT LESS THAN TWO CLEAN ON BOARD LINER TERM OCEAN BILLS OF LADING MARKED“FREIGHT PAYABLE AT DESTINATION”MADE OUT TO THE ORDER OF BURGAN BANK SAK,STATE OF KUWAIT INDICATING BUYERS AS PARTY TO BE NOTIFIED AND SHOULD STATE THAT THE CARRYING VESSEL IS ALLOWED TO ENTER KUWAITI PORTS.SEPARATE DECLARATION TO THAT EFFECT FROM THE OWNER/CAPTAIN OF THE VESSEL IS ACCEPTABLE.

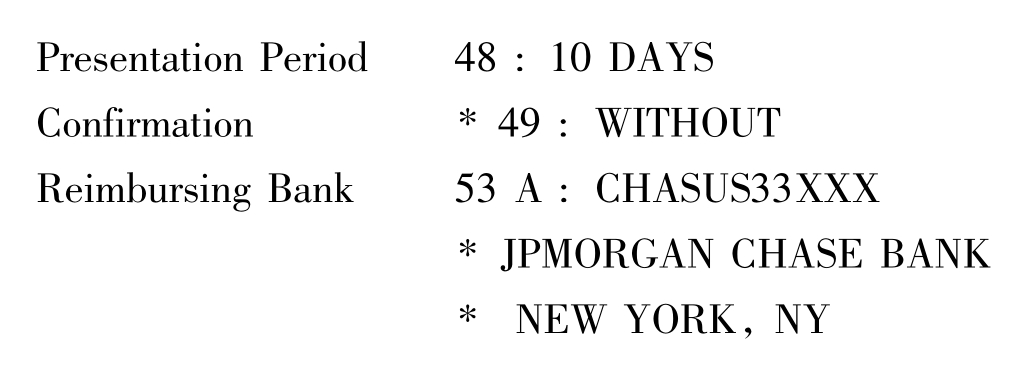

5. INSURANCE POLICY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK FOR 140 PCT.OF C.I.F.VALUE W ITH CLAIMS PAYABLE AT DESTINATION COVERING ALL RISKS AND WAR RISK AS PER AND SUBJECT TO OCEAN MARINE CARGO CLAUSES AND OCEAN MARINE CARGO WAR RISK CLAUSES OF THE PEOPLE'S INSURANCE COMPANY OF CH INA DATED 1/1/1981.ADDITIONAL COND. 47A

1. UNLESS OTHERWISE AUTHORISED DOCUMENTS OF THE FOLLOWING NATURE ARE NOT ACCEPTABLE:

A) INVOICES ISSUED FOR AMOUNTS IN EXCESS OF THE AMOUNT PERM ITTED UNDER TH IS L/C.

B) TRANSPORT DOCUMENTS INDICATING THE CONSIGNOR OF THE GOODS,A PARTY OTHER THAN THE BENEFICIARY OF THE L/C.

C) DOCUMENTS BEARING A DATE OF ISSUE PRIOR TO THAT OF THE CREDIT.

D) DOCUMENTS PRODUCED BY REPROGRAPHIC OR AUTOMATED OR COMPUTERISED SYSTEMS OR AS CARBON COPIES.HOWEVER,SUCH DOCUMENTS,IF MARKED AS ORIGINALS ARE ACCEPTABLE PROVIDED THEY BEAR ORIGINAL MANUSCRIPT SIGNATURES AND WHEREVER APPLICABLE CARRY ORIGINAL(FRESH)STAMPS/SEALS.

E)ANY ALTERATION/CORRECTION ON DOCUMENTS WITHOUT AUTHENTICATION.

F)DOCUMENTS EVIDENCING MANUFACTURERS/PROCESSORS NAME(S)OR ORIGIN OF THE GOODS OTHER THAN THAT MENTIONED IN THE LETTER OF CREDIT.

2.A DISCREP ANCY FEE OF EQUIVALENT KWD 30/-WILL BE CHARGED/LEVIED IF DOCUMENTS ARE RECEIVED WITH DISCREPANCY/IES NOTWITHSTANDING ANY INSTRUCTIONS TO THE CONTRARY AND ALL THE RELATED CHARGES INSIDE AND OUTSIDE KUWAIT ARE FOR THE ACCOUNT OF THE BENEFICIARY.

3.ADMINISTRATIVE/SAFEKEEPING CHARGES OF EQUIVALENT KWD 15/-WILL BE CHARGED/LEVIED BY US FOR EACH DISCREPANT DOCUMENT PENDING ACCEPTANCE/INSTRUCTIONS.NOTWITHSTANDING ANY INSTRUCTIONS TO THE CONTRARY,THIS CHARGE WILL BE FOR THE ACCOUNT OF THE BENEFICIARY.

4.THE NUMBER,DATE OF THE CREDIT AND THE NAME OF OUR BANK MUST BE QUOTED ON DRAFTS AND ALL THE DOCUMENTS.

5.ALL DOCUMENTS CALLED FOR UNDER THIS CREDIT MUST BE IN ENGLISH AND/ OR IN ARABIC.

6.UNDER NO CIRCUMST ANCES MAY OUR A/C BE DEBITED/REIMBURSEMENT BE CLAIMED WHEN THE DOCUMENTS ARE FORWARDED WITH DISCREPANCY/IES.IN SUCH CASES,AUTHORISATION/REIMBURSEMENT WILL BE PROVIDED BY US ONLY AFTER DOCUMENTS HAVE BEEN ACCEPTED.

7.DOCUMENTS WHICH ARE INCOMPLETE AND/OR CONTAIN IRREGULARITIES SHOULD NOT BE NEGOTIATED UNLESS OUR PRIOR APPROVAL IS OBTAINED.

8.MAILING INSTRUCTIONS:COMPLETE SET OF ORIGINAL DOCUMENTS MUST BE DISPATCHEDTOUS BY COURIER SERVICE AND THE DUPLICATE SET OF DOCUMENTS BY REGD.AIRMAIL DIRECT TO US AT:-BURGAN BANK SAK,HEAD OFFICE,PO.BOX5389 SAFAT-13054 KUWAIT,TEL.243900,FAX.2461148

9.IF THIS LC IS NEGOTIATED BY A BANK OTHER THAN THE ADVISING BANKT HE NEGOTIATING BANK IS TO CERTIFY ON THE COVERING SCHEDULE THAT ADVISING BANK CHARGES ARE PAID

10.INVOICES AND CERTIFIC ATE OF ORIGIN WITHOUT ATTESTED BY KUWAITI/GCC EMBASSY/CONSULATE ARE ACCEPTABLE.HOWEVER THE SAME MUST BE LEGALISED BY THE LOCAL CHAMBER OF COMMERCE.

Instructions 78: ALL NEGOTIATIONS MUST BE ENDORSED ON THE ADVICE ISSUED BY THE ADVISING BANK.TH IS CREDIT IS SUBJECT TO ICC UCP PUBLICATION 600 AND REIMBURSEMENT IF APPLICABLE,ARE SUBJECT TO ICC URR 525 NEGOTIATION OR IRREGULAR DOCUMENTS ARE PROH IBITED.AMOUNT OF NEGOTIATION MUST BE NOTIFIED TO US(BURGAN BANK)BY AN AUTHENTICATED MESSAGE GIVING US 3WORKING DAYSNOTICE STATING AMOUNT,VALUE DATE AND L/C NUMBER FOR THE DRAW INGS.

Trailer

Order is<MAC:><PAC:><ENC:><CHK:><TNG:><PDE:>

MAC:B230FA14

CHK:4478D2E95D79

(三)操作演示

广东新天时有限公司业务员李明撰写的业务函电如下:

1.催证函

October 30,20××

James Brown&Sons

#304-310 Jalan Street,Kuwait

Dear Sirs,

Re: S/C No.STNT041088.

With reference to the26 280 pairs of Ladies'Shoes under our Sales Confirmation No.STNT041088,we wish to draw your attention to the fact that the date of shipment is approaching,but up to the presentwe have not received the covering Letter of Credit.Please do your best to expedite its establishment so thatwemay execute the orderwithin the stipulated time.

In order to avoid subsequent amendments,please see to it that the L/C stipulations are in exact accordance with the terms of the S/C.

We hope this letter will receive your prompt attention.

Yours faithfully,

Guangdong New Time Co.,Ltd.

LiMing

2.改证函

November 3,20××

James Brown&Sons

#304-310 Jalan Street,Kuwait

Dear Sirs,

Thank you for your L/C No.LCS220456024012 against our S/C No.STNT041088.After

checking up the clauses in it,we found some clauses do not conform to those in the relative

S/C.Please amend the L/C as follows:

(1) The expiry date and place should be December 15,20××in China.

(2) The beneficiary should be Guangdong New Time Co.,LTD,Shantou,Guangdong,China.

(3) The name of the commodity is“Aily”Ladies'Shoes,not Ladies'Slippers.

(4) The amount should be USD 64 872.00.

(5) The quantity should be 26 280 pairs.

(6) Transhipment is to be allowed.

(7) Please amend“Freight payable at destination”to read“freight prepaid”.

(8) The insurance amount should be 110% of the invoice value instead of 140%.

We shall appreciate your immediate amendments to the L/C to enable us to make timely shipment.

Yours faithfully,

Guangdong New Time Co.,Ltd.

LiM ing

五、强化训练

(一)业务背景

9月26日广东天贸有限公司收到THE CHUGOKU BANK LTD. TORONTO BRANCH开来的信用证。

(二)操作指示

请你以公司业务员的身份,根据双方签署的贸易合同(参见P65~66)对来证进行审核,找出不符点并拟写改证函。

【国外来证】

EXPORT L/C

33062 BOCSH CH.

SEPTEMBER 26TH,20××

TO:BANK OF CH INA,GUANGZHOU

FROM:THE CHUGOKU BANK LTD TORONTO BRANCH

WE OPEN IRREVOCABLE DOCUMENTARY CREDIT NO.0470/209387 ISSUED ON SEPTEMBER 26TH,20××

APPLICANT: V IPORT PORCELAIN PRODUCTS CO.,LTD 168 HARAYAMA-CHO,TORONTO,CANADA BENEFICIARY: GUANGDONG TIANMAO CO LTD.1450 QIAOGUANG ROAD GUANGZHOU,CH INA

AMOUNT: USD 20 275.20

CREDIT AVA ILABLE W ITH ANY BANK BY NEGOTIATION OF DRAFT AT 30 DAYS AFTER SIGHT FOR 100 PERCENT INVOICE VALUE DRAWN ON THE CHUGOKU BANK LTD.,TORONTO BRANCH.

EXPIRY DATE AND PLACE:OCTOBER 15TH,20××AT NEGOTIATING BANK'SCOUNTER

LATEST SH IPMENT: SEPTEMBER 30TH,20××

PARTIAL SH IPMENTS: NOT ALLOWED

TRANSH IPMENT: PROH IBITED

SH IPMENT: FROM GUANGZHOU TO TORONTO COVERING 2 382 SETS OF CH INESE DINNER SET AS PER SALES CONFIRMATION NO 06SHJY-0014 DATED SEPTEMBER 23TH,20××CIF VANCOUVER

REQUIRED DOCUMENTS AS FOLLOWS:

—SIGNED COMMERCIAL INVOICE IN SIX COPIES DULY SIGNED STATING SALES CONFIRMATION NO 06SHJY-0014 DATED SEP.23RD,20××.

—PACKING LIST IN SIX COPIES

—FULL SET(3/3) COMBINED TRANSPORT CLEAN ON BOARD BILL OF LADING MADE OUT TO OUR ORDER,MARKED FREIGHT PREPAID NOTIFYING APPLICANT

—INSURANCE POLICY OR CERTIFICATE IN TWO COPIES,ENDORSED IN BLANK,FOR 110 PERCENT OF THE INVOICE VALUE COVERING ALL RISKS AND WAR RISK AS PER OCEAN MARINE CARGO CLAUSES AND WAR RISK CLAUSES OF THE PEOPLE'S INSURANCE COMPANY OF CH INA DATED 1/1/1981 W ITH CLAIMS ARE TO BE PAYABLE IN CANADA IN THE CURRENCY OF THE DRAFT.

ALL BANKING CHARGES INCLUDING REIMBURSEMENT COMM ISSION OUTSIDE CANADA ARE FOR ACCOUNT OF BENEFICIARY.

DOCUMENTS TO BE PRESENTED W ITHIN 15 DAYS AFTER THE DATE OF ISSUANCE OF THE SH IPPING DOCUMENTS BUT W ITH IN THE VALIDITY OF THE CREDIT

SPECIAL INSTRUCTIONS:

—T.T.REIMBURSEMENT IS NOT ACCEPTABLE

—THIS CREDIT IS NOT TRANSFERABLE

(1) COUNTRY OF ORIGIN MUST BE DECLARED ON SIGNED COMMERCIAL INVOICE

(2) 5 PERCENT MORE OR LESS BOTH IN QUANTITY AND AMOUNT IS ALLOWED

(3) SH IPPING MARKS: T.M/EIO18231/TORONTO/NO.l—UP

(4) IMPORT LICENCE NUMBER EIO18231 MUST BE INDICATED ON ALL SHIPPING DOCUMENTS EXCEPT DRAFTS

(5) DOCUMENTS PRIOR TO THE ISSUANCE OF THIS CREDIT ARE NOT ACCEPTABLE

INSTRUCTIONS TO NEGOTIATING BANK:

ALL DOCUMENTS TO BE SENT TO US IN ONE LOT AIRMAILING ADDRESSING TO THE CHUGOKU BANK LTD.,4-2-l IMBAASH I CHUO-KU TORONTO

DRAFTS TO BE AIRMAILED TO DRAWEE BANK IN ONE LOT FOR REIMBURSEMENT SUBJECT TO U.C.P.2007 ICC PUBLICATION NO.600.

(三)模拟操作

经审核国外来证发现以下不符点,并向国外客户提出修改意见。

1.不符点:

2.拟写改证函

免责声明:以上内容源自网络,版权归原作者所有,如有侵犯您的原创版权请告知,我们将尽快删除相关内容。